Microsoft stock is on fire in 2023, but I’m not buying: Here’s 4 reasons why

1. The Price: It’s currently selling for a P/E ratio of 32 which is no menial price tag. Market cap to free cash flow is even worse at 39. I’m often prepared to pay p/e’s like this for a high growth, less mature company, this is not Microsoft. Microsofts growth is good but not great.

2. Growth: over the past 11 years Microsoft has grown by 11%. Very good for such a high market cap company I’ll admit but nothing crazy. Yes ok, they’ve increased growth to 16% over the last 3 years but this cannot go on forever.

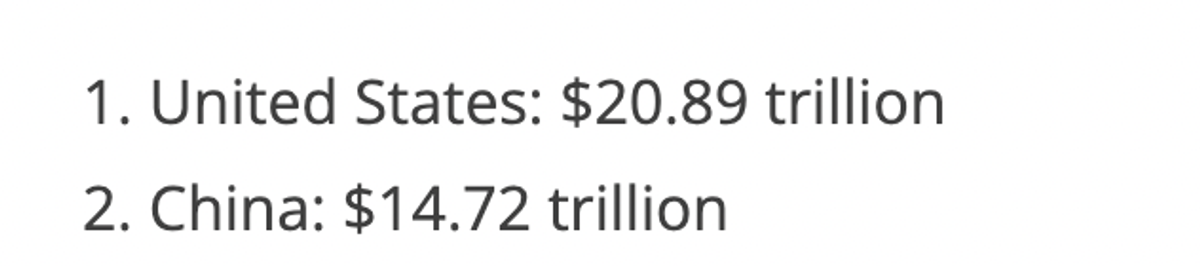

3. Law of large numbers: the bigger companies become the harder they are to double, triple and 10x in price. If Microsoft 10xd they would be worth $27 trillion more than the entire GDP of the United States!

4. Spread Out Businesses: Microsofts business model consists of: cloud services, office products, windows, Activision blizzard, Linked In, Xbox, Open AI, Bing, Enterprise & devices. All of these industries are VERY competitive and the slight loss of focus can result in another company stealing your market. To maintain dominance in these fields a lot of time, focus and money must be put in, not easy when you’re so spread out.

This is just food for thought. Obviously Microsoft has a lot of positives too. Sam Altman & Satya Nadella I wouldn’t want to compete with on the best of days!